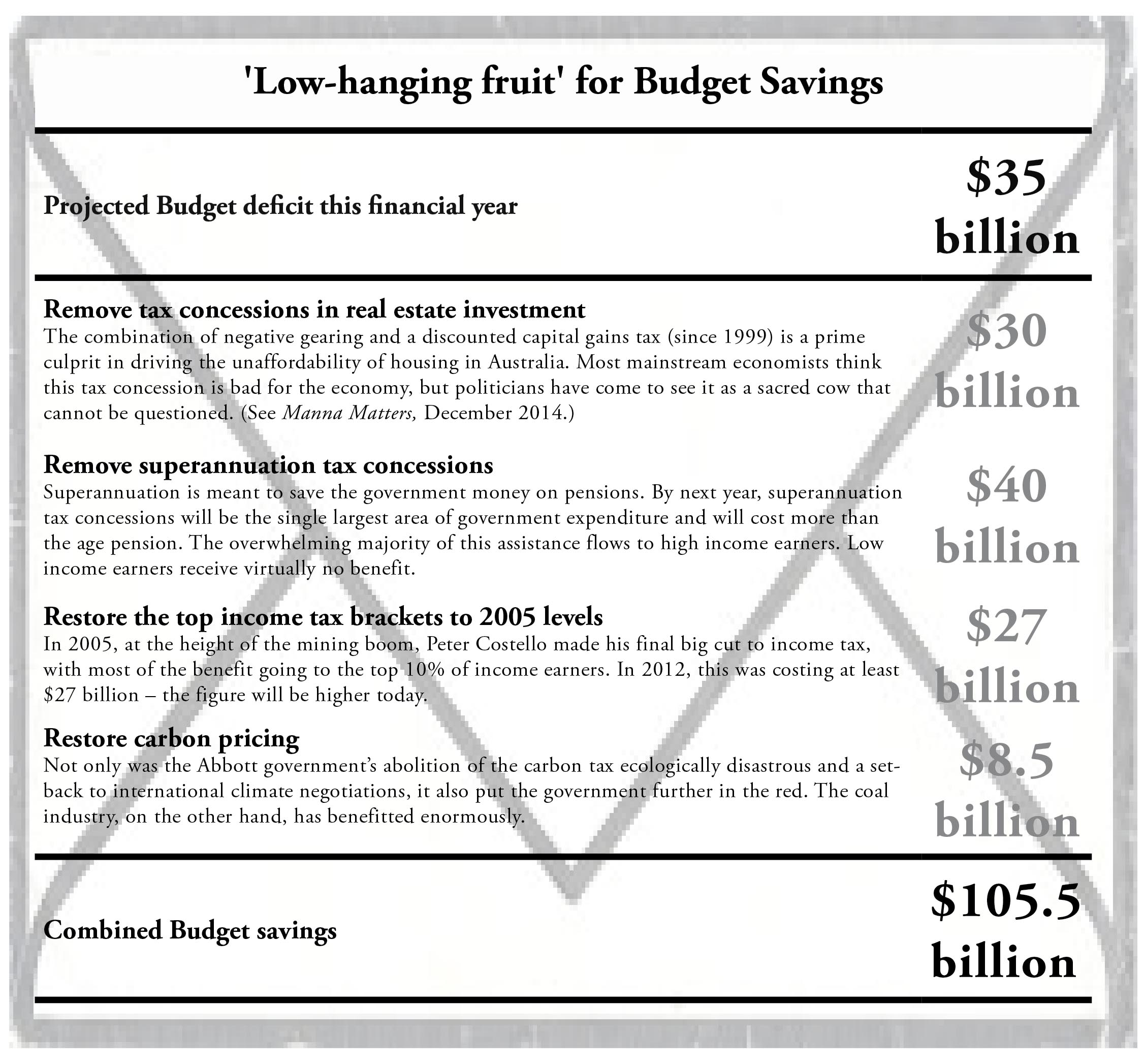

Perspective is a funny thing. For all the talk in Canberra, you would think that Australia’s ‘Budget black hole’ of around $35 billion has become an almost unsolvable problem. However, Manna Gum’s ‘back-of-the-envelope’ calculations suggest that there are a bunch of ‘low hanging fruit’ options that could easily return the Budget to surplus, by a long way. The fact that they are not being explored reveals much about the control and exercise of political power in Australia.

Manna Gum’s modest proposals are not ideas coming from lefty radicals. Mostly, they involve simply undoing changes that were made in the mid-2000s (1999 for the capital gains tax), a period in which, according to the IMF, welfare to the rich in Australia became ‘profligate’. The budget measures proposed here have support amongst many mainstream economists and economics commentators, and it is generally considered they would have a beneficial impact on the broader economy.

The 2014 Budget

Last year, Treasurer Joe Hockey said the seriousness of the deficit meant it was time to get tough and end ‘the age of entitlement’. His cuts made it clear who he thought was benefiting from such ‘entitlements’. Most severely affected by the 2014 Budget cuts were unemployment benefits, age pensioners, Medicare, hospitals, tertiary education, foreign aid and public service jobs. It is telling that the much more expensive forms of 'entitlement' highlighted below have not been up for discussion.