|

If someone looked at your budget, would they know you are a Christian?

A good friend once told me: your budget is a reflection of what you value. At both a national and individual level, the decisions we make about money tell us a lot about what we care about.

And yet, it’s taboo to share about struggling with debt, discuss salaries or wealth, or sometimes even talk about how we spend money. If we could share humbly and openly about money, we might help and learn from each other, feel a sense of control over our finances, cooperate to avoid high-interest, institutional loans, and hold each other more accountable to using money in a way that reflects our values (and hopefully Christ’s values too). So, while sharing an example of our budget is scary, I believe it is important, and even useful.

Why Budget?

Money is an immensely powerful spiritual force, so it’s important to consider how and to what extent it shapes our lives. Our faith calls us to consider how we steward God’s resources, to reflect on the struggle of worshipping God or money, to contribute to justice, and to participate in God’s message of abundant life for all. Budgeting holistically can help us practise the basics that Jesus advocated to break the power of money: renunciation, generosity and gratitude.

Budgeting can also reduce financial stress, inspire us to be more generous, and help us make informed life decisions. Recently, when my husband and I wanted to make a few changes in our life, our budget (from numerous years of records) showed us we could, and are, living comfortably off one person working three days a week, with the occasional dip into our savings for what they were ticketed for, like ‘unexpected’ car maintenance.

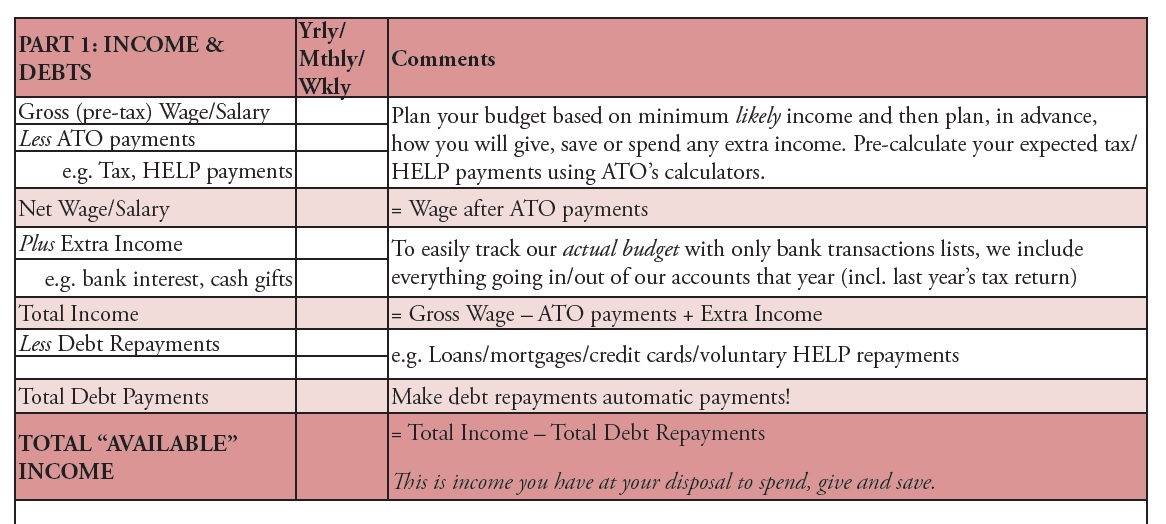

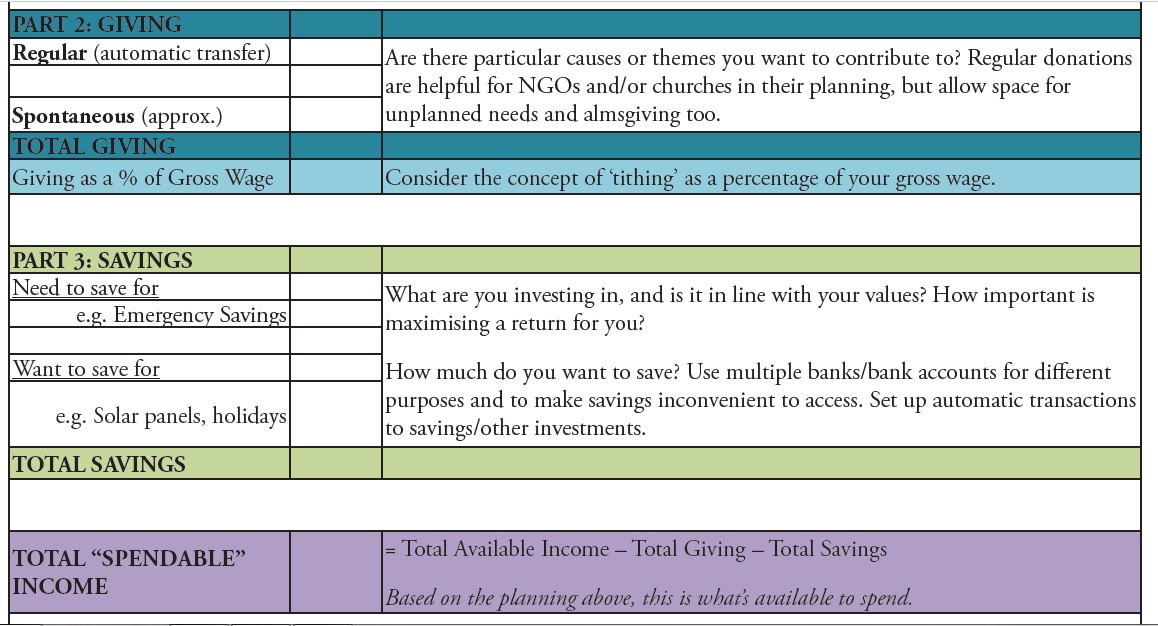

We break down our budget into four parts to reflect our values and priorities in planning, and try to focus on the following:

Key goals/considerations |

|

1: Debt and Income |

|

2: Giving |

|

3: Saving |

|

4: Spending |

|

Big Picture Questions to Ask When Budgeting

When preparing a projected budget for the year:

- Do you have enough? How can you contribute to abundant life for all in your budget?

- What values do you want to be clear from your budget?

- What financial goals do you want to facilitate through your budget?

When implementing and recording your actual budget:

- How will you check in throughout the year?

- What do you want to know (and therefore need to track)?

- What would help you to be more accountable with your money?

When reflecting on your actual budget and expenses at the end of the year.

- What values are evident in your actual budget?

- What in your budget surprises you or makes you feel uncomfortable?

- How do you want it to look different next year?

|

|

| Casual sport with friends is a great way to exercise and have fun on the cheap. |

Hiking and camping can help reduce costs while still enjoying a holiday. |

A Budget Template

Below is the template we use to:

- Start the year with a projected budget to plan what income we will have, how we will use it, and what other information to gather.

- Track our incomings and outgoings throughout the year in an actual budget.

- Reflect on our actual budget for the year gone, and decide what we want to change next year.

Your budget could look like this, or quite different: organise the ‘parts’ to reflect your priorities and plan/track your budget on the timescale that best suits your bills/income frequency.

This template includes an example actual budget of Part 4: Spending that includes an average of our yearly budgets over the last three financial years, for a couple in Melbourne with minimal debts. To use this template yourself, download the pdf or (editable) word document.

.jpg)

There are hundreds of things we could critique in our budget. We wrestle with competing values (e.g. to save or give away), questions about what to prioritise (e.g. ‘live simply so that others may simply live’ or more ethical purchasing goals), the calling of our faith (e.g. would Jesus in 2022 have savings in a bank account at all? Probably not!), and my upbringing that valued financial security. In some ways, our budget shows the conflict between these issues, and how we balance those conflicts changes over time, different seasons with different focuses and needs. Your budget, as with your values, priorities, and balancing of the conflicts of money will be different. I would argue wrestling with those conflicts is a healthy spiritual discipline.

Final Tips for Budgeting and More

- Make your budget as simple and easy as you need so you will actually do it; notations on a napkin are better than nothing!

- Preference automatic transactions, set up by you or deducted automatically for regular giving, paying bills or regularly putting into your savings account(s).

- Set up a regular weekly transfer to your debit card for ‘discretionary spending’ (e.g. coffees out) to help limit and savour luxury items.

- Shop around for ethical banks/super/investments, considering returns but being willing to forego maximum returns to invest in more neutral/good things (see MarketForces.org.au).

- Check your bank account(s) every so often to get a sense of your spending.

- To track your spending, ask for and keep receipts, and/or use a spreadsheet, download your bank transactions, or use a spending tracking app.

Dive deeper

See Manna Gum’s plethora of other articles on money (e.g. MM May 2016), wealth (e.g. MM May 2015), investment (e.g. MM Nov 2021), living simply (e.g. MM April 2013), responsible consumption (e.g. MM Sept 2019), the role of giving in discipleship (e.g. MM Aug 2011), and particularly, the Household Covenant (available at mannagum.org.au).

Lauren is a lawyer who, despite not getting to use them in her day job, loves spreadsheets. She is not a financial advisor…